child tax credit portal

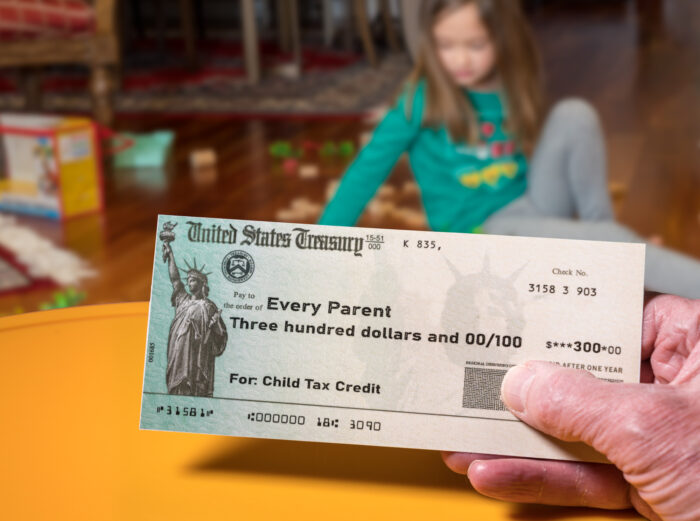

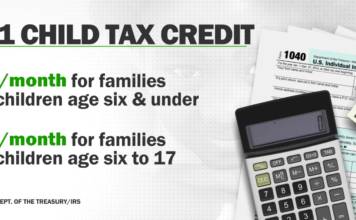

Already claiming Child Tax Credit. The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17.

Irs Adds Address Change Capability To Child Tax Credit Portal Nstp

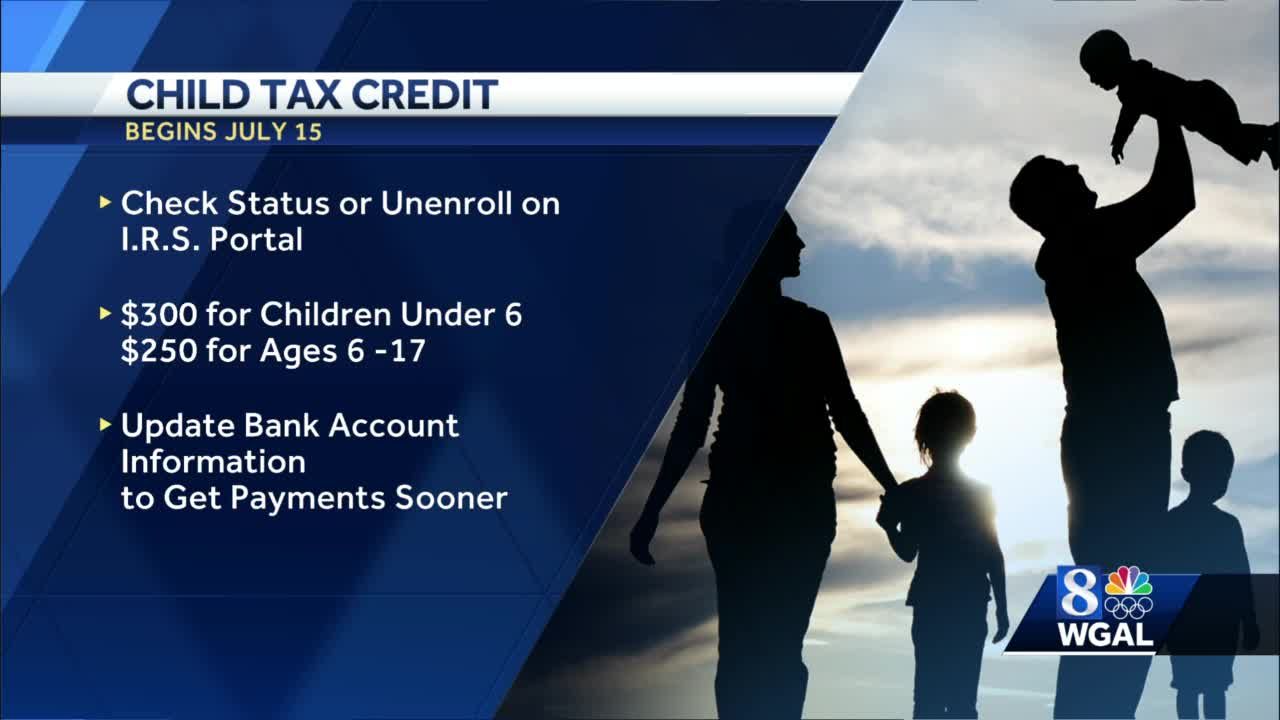

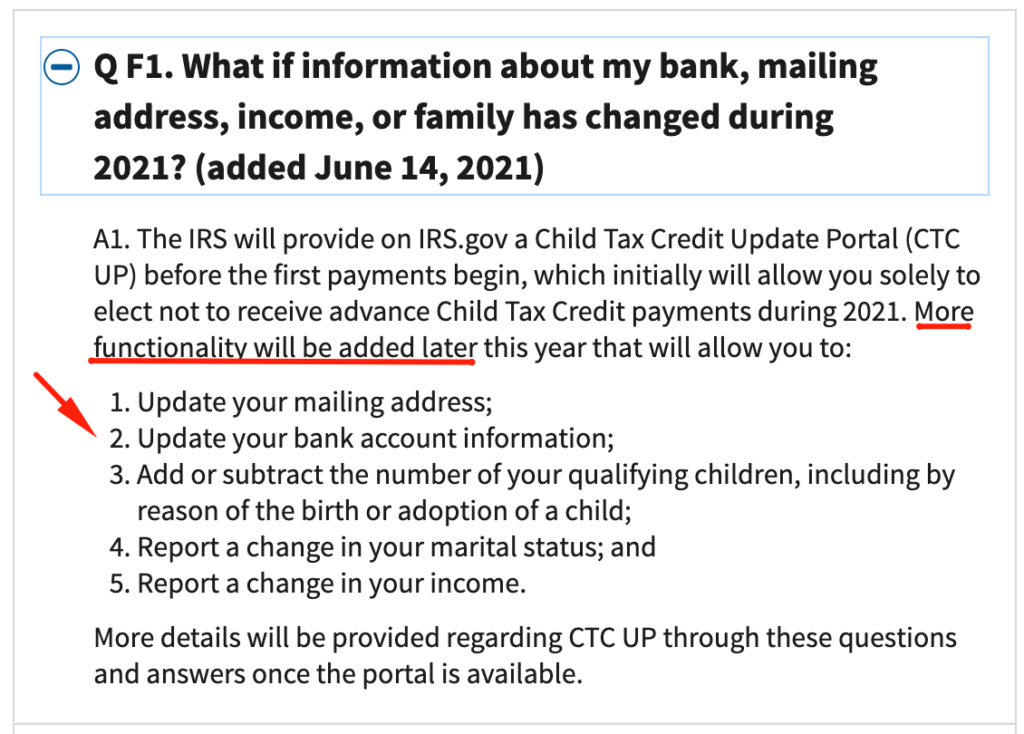

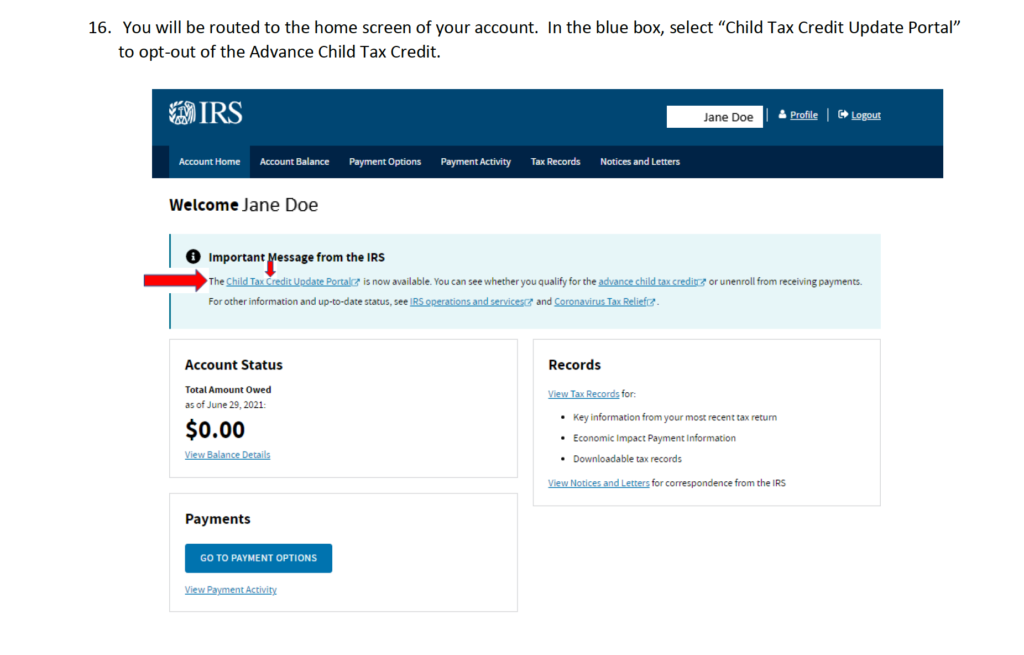

The Child Tax Credit Update Portal has been updated to allow families to update their direct deposit information or to unenroll from receiving advance payments for the child.

. The IRS will add more features to the Child Tax Credit Update Portal through the summer and fall. By claiming the Child Tax Credit CTC you can reduce the amount of money you owe on your federal taxes. It is important to note that even the lowest-income families with children are eligible for this tax.

Connecticut State Department of Revenue Services. You can be eligible even if you. Benefits range from 2000-3600 depending on the childs age and household income.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

Making a new claim for Child Tax Credit. Single or married and filing separately. After that families can still claim the 2021 CTC but will need to file.

IR-2021-235 November 23 2021 WASHINGTON The Internal Revenue Service this week launched a new Spanish-language version of the Child Tax Credit Update Portal CTC. The Child Tax Credit will help all families succeed. Have been a US.

By fall people will be. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. For 2021 eligible parents or guardians can.

The amount of credit you receive is based. If you received any monthly Advance Child Tax Credit payments in 2021 you need to file. The amount you can get depends on how many children youve got and whether youre.

To apply applicants should visit. Y ou can now adjust your income in the Child Tax Credit Update Portal but you have to do it by midnight Nov. Apply by November 15 and you could get up to 3600 per child with Child Tax Credit funds andor the 3rd stimulus payment of 1400 for yourself and each child.

The credit amount was increased for 2021. Here is some important information to understand about this years Child Tax Credit. To get money to families sooner the IRS is sending families.

For changes to reflect on your Dec. To be eligible for this rebate you must meet all of the following requirements. IMPORTANT INFORMATION - for filers of the following tax types.

Most families will receive the full amount. Soon people will be able update their mailing address. 3600 for each child under age 6 and 3000 for each child ages 6 to 17.

THE IRS has launched child tax credit online portals that will help parents to get the extra stimulus money when the monthly 300 payments begin on July 15. Advance Child Tax Credit. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from.

You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children. Department of Revenue Services. The Child Tax Credit provides money to support American families.

A childs age determines the amount.

The Irs Just Opened The Portal For Parents To Register For The Monthly Cash Payments

Irs Opens Non Filer Portal For Child Tax Credit Registration

Child Tax Credit Payments Go Out On Thursday

How To Apply For The Child Tax Credit With The Irs Non Filer Sign Up Tool Youtube

November 15 2021 Deadline For Non Tax Filing Families To Use Child Tax Credit Portal Lone Star Legal Aid

Twitter 上的 H R Block A Portion Of Your Child Tax Credit Payments Will Now Be Distributed Through Advance Payments If You Want To Opt Out Of These You Ll Need To Do So By

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Internal Revenue Service Launches Web Portal For Child Tax Credit Giving Non Filers Four Weeks To Declare Eligibility

Child Tax Credit Portal How To Use The Irs Tool To Enroll For 2021 Nj Com

Irs Adds Address Change Capability To Child Tax Credit Portal Where S My Refund Tax News Information

Families Receiving Monthly Child Tax Credit Payments Can Now Update Their Direct Deposit Information The Georgia Virtue

How The 3 000 Child Tax Credit Could Affect Your Tax Bill

Tools To Unenroll Add Children Check Eligibility Child Tax Credit

2nd Child Tax Credit Portal Now Open

Child Tax Credit Payments Unenrollment Process Lupe Ruiz

Child Tax Credit New Update Address Feature Available With Irs Online Portal Youtube

How To Opt Out Of The Advance Child Tax Credit Payments

Child Tax Credit Portal How To Update Your Income Details Before November 29 Marca

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet